.cwp-coin-chart svg path {

stroke-width: 0.65 !important;

}

.cwp-coin-widget-container .cwp-graph-container.positive svg path:nth-of-type(2) {

stroke: #008868 !important;

}

.cwp-coin-widget-container .cwp-coin-trend.positive {

color: #008868 !important;

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.positive {

border: 1px solid #008868;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.positive::before {

border-bottom: 4px solid #008868 !important;

}

.cwp-coin-widget-container .cwp-coin-price-holder .cwp-coin-trend-holder .cwp-trend {

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-graph-container.negative svg path:nth-of-type(2) {

stroke: #A90C0C !important;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.negative {

border: 1px solid #A90C0C;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.negative {

color: #A90C0C !important;

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-coin-trend.negative::before {

border-top: 4px solid #A90C0C !important;

}

Bitcoin

1.08%

Bitcoin

BTC

Price

$87,159.04

1.08% /24h

Volume in 24h

$48.72B

Price 7d

// Make SVG responsive

jQuery(document).ready(function($) {

var svg = $(‘.cwp-graph-container svg’).last();

if (svg.length) {

var originalWidth = svg.attr(‘width’) || ‘160’;

var originalHeight = svg.attr(‘height’) || ’40’;

if (!svg.attr(‘viewBox’)) {

svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight);

}

svg.removeAttr(‘width’).removeAttr(‘height’);

svg.css({‘width’: ‘100%’, ‘height’: ‘100%’});

svg.attr(‘preserveAspectRatio’, ‘xMidYMid meet’);

}

});

Learn more

has climbed from its dip to $84,000 and is now trading close to $87,000, drawing attention again from large investors and smaller traders looking for the next 100x crypto. Today’s rebound reflects rapid stabilization after Bitcoin briefly fell below $84,000 due to thin liquidity and nearly $1 billion in forced liquidations across leveraged positions.

By midday, BTC returned to the $86,500–$87,200 zone, roughly 3% above its intraday low. The move follows a tough November in which Bitcoin shed over $18,000 as ETFs saw record monthly redemptions of $3.47 billion, the worst since February.

Yet on-chain activity shows large holders quietly accumulating, while technical data highlights firm support near $86,000. Analysts believe Bitcoin could attempt a run toward $100,000 if December inflows reappear, especially with historical averages pointing to a 9.7% gain for the month.

Grayscale Research expects Bitcoin to set new all-time highs in 2026, pushing back against the widely held “four-year cycle” narrative. The firm said this cycle has not seen the usual parabolic surge driven by retail traders, with institutional inflows, potential rate cuts, and…

— Wu Blockchain (@WuBlockchain) December 2, 2025

EXPLORE: 10+ Next 100x Crypto to Buy

Traders Explore the Next 100x Crypto As Vanguard’s New Policy Signals a Major Shift for Traditional Finance

One of the main catalysts behind today’s recovery is Vanguard’s sweeping policy change. The $11 trillion asset manager announced that, starting December 2, it will allow clients to trade crypto ETFs and mutual funds, reversing years of exclusion. This includes products tracking Bitcoin, Ether, XRP, and Solana, opening access to more than 50 million customers. Vanguard cited improved administrative frameworks and shifts in investor behavior, even as the crypto market has declined by $1 trillion since October. The change could introduce new capital into Bitcoin ETFs, which collectively hold $113 billion, offering potential relief from recent outflows and supporting price stability.

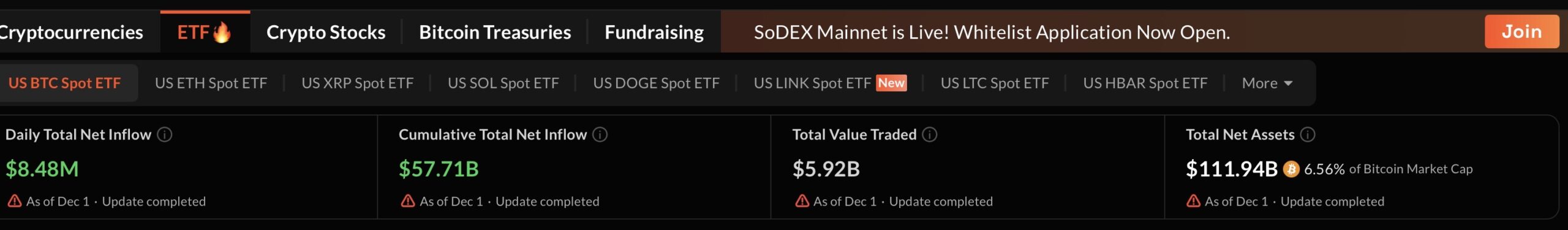

ETF activity remains crucial, with spot Bitcoin funds experiencing heavy withdrawals in November but now showing early signs of levelling off.

BlackRock’s IBIT, currently the largest with $70 billion in assets, recently increased its internal allocations, contributing to today’s rebound. Meanwhile, the Federal Reserve’s decision to end quantitative tightening, pausing its $2.2 trillion reduction in balance-sheet assets, eases liquidity constraints: conditions that often benefit assets like Bitcoin.

(Source: Sosovalue)

(Source: Sosovalue)

Additional movements include Coinbase’s Q4 index update, adding HBAR, MANTLE, VET, FLR, SEI, and IMX to track high-liquidity performers. Franklin Templeton also expanded its Crypto Index ETF to include Bitcoin, Ether, Solana, XRP, and several others, widening exposure for investors.

Altogether, Bitcoin’s rebound, Vanguard’s unexpected policy reversal, and the Fed’s liquidity shift create a constructive setup for the market. With traders monitoring both established assets and possible next 100x crypto opportunities, December could open the door to meaningful market progress.

DISCOVER: Vanguard Crypto ETF Greenlight Could End The Crypto Crash Today

44 minutes ago

Buy Now, Pay Later use surges this Black Friday

![]()

By

Usage of Buy-Now-Pay-Later (BNPL) jumped about 9% during this Black Friday period, the biggest surge in years. Younger shoppers led the charge: 41% of people aged 16–24 used BNPL, and younger millennials boosted their usage by a dramatic 87% compared with last year.

Wealthier households are increasingly embracing BNPL too, with 38% of those earning over US$100,000 reporting they used it. Crucially, BNPL is no longer reserved for luxury purchases: now around one in four BNPL users are financing essentials like groceries.

2 hours ago

Crypto Mixer Crushed: Europe Shuts Down Cryptomixer.io in Major Anti-Laundering Sweep

![]()

By

Swiss and German law enforcement just dropped the hammer on Cryptomixer.io, one of the largest Bitcoin “tumblers” in the wild. Multiple agencies, including Zurich police and Germany’s BKA, dismantled the platform last week.

Europol supports Germany and Switzerland in taking down ‘Cryptomixer’, seizing EUR 25 million in Bitcoin. This illicit mixing service facilitated money laundering of proceeds from a variety of criminal activities.

Details  https://t.co/d3oTlbrDzd pic.twitter.com/Qtml6nhGlX

https://t.co/d3oTlbrDzd pic.twitter.com/Qtml6nhGlX

— Europol (@Europol) December 1, 2025

Cryptomixer had been mixing coins since 2016, allegedly shuffling billions of euros in potentially dirty Bitcoin. By blending funds across users and randomizing payouts, it masked where coins came from and where they ended up — a classic setup for laundering proceeds from ransomware, drug dealing, fraud, and other shady business.

The takedown was sweeping: authorities seized three servers, the domain cryptomixer.io, 12 terabytes of data, and over €25 million (~$29 million) in Bitcoin.

Agencies behind the raid, including Europol and Eurojust, said this isn’t just about a single platform: the evidence and data they grabbed could fuel investigations into entire networks of cybercrime.

DISCOVER: Best New Cryptocurrencies to Invest in 2025

Read the Full Article Here

4 hours ago

Merlin BTC Layer 2 Defies Market Dip as MERL Crypto Pumps +30%: Is Bitcoin Hyper Next BTC Layer 2 To Blast?

![]()

By

MERL Crypto or Merlin Chain (MERL) is back in the spotlight after doubling in price today, continuing a comeback that has been building quietly since early fall. The latest surge follows the project’s November 7 network upgrade, which improved scalability, reduced congestion and boosted ZK-Rollup efficiency across the chain.

Combined with August’s Sui integration, bringing new Bitcoin DeFi functionality through M-BTC bridging, Merlin is finally delivering on the infrastructure that early supporters expected.

Merlin spent most of the summer stuck in a grinding correction, bottoming in June before beginning a slow climb. The real shift occurred in September when MERL broke out of a diagonal resistance trendline. Meanwhile, a new crypto presale is making waves as the next big Bitcoin play. Here’s what to know:

Read the Full Article Here

4 hours ago

Japan Crypto Moves Toward Flat 20% Crypto Tax as Government Backs Major Reform

![]()

By

Japan is preparing to overhaul its crypto tax system after more than a decade of investor complaints and industry lobbying. According to new reporting from Nikkei Asia, the government and ruling coalition have formally endorsed a plan to cut the nation’s maximum crypto tax rate to a flat 20%, aligning digital assets with equities and investment trusts.

The Financial Services Agency (FSA) is expected to introduce the crypto bill during the regular Diet session in early 2026.

The decision marks one of the most consequential shifts in Japan’s digital-asset policy since the collapse of Mt. Gox in 2014. It also reflects a growing political will to revitalize Japan’s stagnant cryptocurrency sector, which has been hindered for years by punitive tax rules.

DISCOVER: 20+ Next Crypto to Explode in 2025

Read the Full Article Here

The post [LIVE] Crypto News Today, December 2 – Bitcoin Rebounds to $87K, Vanguard Opens to Crypto ETFs, Fed Ends QT: Next 100x Crypto? appeared first on 99Bitcoins.